Large banks and companies borrow money amongst themselves for overnight cash flow planning and reserve requirements by their treasury departments. This is called the overnight repo market and is a trillion-dollar market (repo refers to repurchasing government treasury debts). There was such a shortage of available money last week, that overnight interest rates spiked from 2% to 10%. This spike was so high that the U.S. Federal Reserve injected billions to stop the overnight market from freezing up.

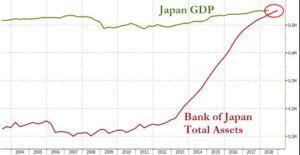

What is going on? Since the 2008 financial crisis, the U.S. Federal Reserve has put trillions into the U.S. financial markets by purchasing all kinds of bonds. This provided liquidity to all of the large U.S. money-center banks that were insolvent at the time, and boosted the economy. Over a decade later, in order to draw some of that extra trillions back out of the economy, the Federal Reserve has been selling bonds and allowing some to mature, pulling billions out of the financial system for about the past two years. This contraction of money will slow the economy, and banks hitting cash shortages resulted in last week’s overnight spike.

When a bank cannot get money in the overnight repo market from other lenders, then the lender of last resort is the U.S. Federal Reserve’s ‘Discount window.’ For several nights in a row the Federal Reserve had to buy $75 billion worth of bank assets to support the banks. Granted, it was not a normal day (corporate tax payments were made plus U.S. debt auction settlements – both of which sucked money out of the banking system), but all of this was known well in advance.

There are two views of this event:

1) The Fed now knows that they need to provide a much higher level of liquidity in the repo market, and they are doing that, so everything is operating normally.

2) This highlights that the banking system is so fragile that it could collapse any moment! The repo market is the canary in the coal mine for the rest of the banking system. (The average treasury security is re-collateralized 2.2 times so 3 people can believe that they each own the same asset. It is a game of musical chairs that isn’t well tracked.)

My view is that opinion #1 is correct in the short-term, that this was no big deal to the banks or the economy. However, it is still a colossal amount of money and I expect the Fed will have to lend around a half a trillion over a 3 week period. The size of this repo problem is unsettling, which leads to opinion #2: it may also be correct in the very-long term. As money manager Mitch Feierstien says, “You cannot taper a Ponzi scheme” and the Federal Reserve has been kicking this can down the road since its founding in 1913. They ramped up money printing in 1971 (when the U.S. went off the gold standard), and supercharged the money printing in 2008 with over $4 trillion. Just retracting a little of that extra money sloshing around the economy nearly seized up the overnight lending market. It appears that permanent money printing (called quantitative easing by the Fed) may not be reversed without adverse consequences. We all know how Ponzi schemes end, but I do not see signs that it will happen soon. (Although JP Morgan just informed their wealthiest retail banking clients that the U.S. dollar is losing it’s world reserve status so they should begin diversifying their assets into gold and Swiss Francs). Prudent risk management of your money is always important. Planning for unfavorable economic scenarios, even during these current times of high employment, is highly advised.

What will a financial crisis look like? The same as they usually do:

- Liquidity will freeze in a specific market (buyers will step away from making a price in an industry that is in a speculative bubble at the time, and those asset prices will fall).

- That liquidity crisis will begin a credit crisis (lenders will withdraw from making loans, it could begin in junk bonds, overnight repos, real estate loans, corporate bonds, or loans in industries in a speculative bubble like student loans or small oil frackers).

- The lack of lending will begin loan defaults from companies relying too heavily upon them.

- Those defaults will begin a cascade of secondary and tertiary defaults as solid loans are called-in by banks to be paid off immediately.

- The expectation of further defaults will cause the stock market and bond market to fall.

- The cascade of defaults will begin a currency crisis as demand for the dollar will fall.

- Jobs are quickly reduced, financial markets fall, businesses retreat, and a recession begins.

Much of this volatility will occur simultaneously, over hours and months, as government officials get in front of any camera, repeating that, “The problem is contained, there is absolutely nothing to worry about,” (exactly as they did throughout 2007-2009).