New U.S. Congresswoman, Ocasio-Cortez would like a confiscatory tax rate of 70% for personal income above $10 million dollars to pay for her socialist government goals. Setting aside socialism, let’s examine two critical questions: will this tax plan work and how will taxpayers react?

The first question, will it work, we can already assess by

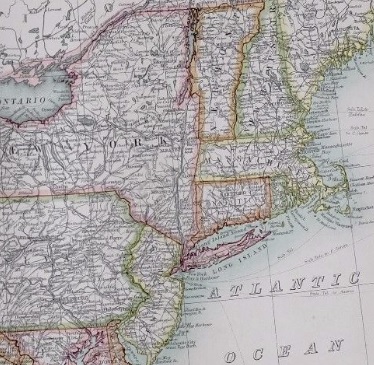

many recent examples of this new income tax. The states of Maryland, New

Jersey, Washington DC, and others have imposed a “millionaire tax” for their

highest income earners in the last few years. What happened? The income taxes collected from their highest

earners fell – it backfired for all of these states. The exact same result

happened recently in France and Canada when their socialist presidents tried it

(Hollande and Trudeau). Why does a higher

marginal income tax rate mostly backfire? Anytime you increase someone’s

opportunity cost, they go far out of their way in effort and money to avoid it.

(For example, the anecdotal evidence from Maryland, D.C., and New Jersey was

that many of their high-income earners had a second or third home in a lower

taxation state, and they simply changed their declared domicile to that other

state. If they didn’t have this option, they simply moved out of state, usually

to Florida, and took their entourages of advisors with them).

Now the second question: How will taxpayers react? Let’s

examine; who actually earns more than $10

million a year? Nearly all of them are business owners, aside from a few

movie, music, and sports stars. How do

they pay their income taxes? Each year, they sit down with their tax

attorney, accounting firm, banker, insurance agent, investment broker, and

other advisers to map out and coordinate the next 5 years of activities and tax

laws. Together, they optimize the high-income earner’s financial situation and

minimize their lifetime tax liabilities. Some top earners also consider the tax

consequences for several generations of inheritance. As a business owner, they

have many “levers” to manipulate:

- How much salary they want to take

- How much dividends and/or capital gains they

want to take

- How much deferred compensation they want to take

- How much of one type of income they want to

convert into another type of income

- When to time spending and donations for tax

deductions

- How to increase depreciation or other IRS

incentives to reduce taxes

- Which tax credits do they want to select to

reduce their taxes

- And many more levers such as life-insurance

arbitrage or captive insurance

I have attended one of these meetings and was rather

shocked at the size of their tax-lowering menu that they can choose among. One

of the options is to actually pay zero income taxes and there are two ways

someone wealthy can achieve this within two or three years. First, purchase many

apartment buildings (or commercial real estate) and the depreciation will drive

your taxable income much lower, and if you want, all the way down to nothing. (One

acquaintance started with 1 rental property and now has 6,300 units; he cannot

remember the last time he paid income taxes to the state or federal government.)

The second method allowing a wealthy business owner to

pay zero income taxes is to choose not to have any income and borrow all of the

money that they spend. The high-income earner could change their salary and

dividend withdrawals to zero, and let’s say they spend $5 million a year on

their luxury lifestyle. They borrow $5 million, every year, for the rest of

their life for spending money. The cumulative loans and interest are re-paid at

their death from insurance policies and/or their pledged business assets. This

is exactly how many earners in the top 0.01% already pay nothing in income tax

all over the world. Because they don’t have any income, they just spend loaned

money, perhaps from an offshore trust. If confiscation tax rates were enacted

at the federal level, these strategies (and many, many others) would quickly

become commonplace for incomes much lower than $10 million.

When a politician increases income tax rates, let’s say to grab an extra $2 million from someone very rich – they only see the new money that they can spend on pet projects. What these politicians ignore is that the taxpayer now has a $2 million incentive to lower his or her tax burden. Plus, they can spend $1.9 million of that money on tax experts to find a way to make that happen and still come out ahead. In my opinion, Congresswoman Ocasio-Cortez’s new 70% marginal tax rate, if enacted, would result in yet another taxation backfire for the socialists.