While some companies slowly march toward obvious bankruptcy (Blockbuster Video, Kodak, Sears, etc.), others are technically insolvent but still able to lope along for years. Let’s examine three current large ones that, in my opinion, are The Walking Dead still loping along.

General Electric

GE has been a manufacturing powerhouse for over 100 years, and at one point was the 4th largest company in the world. GE once had a AAA credit rating and today their bonds sell at junk-rated levels (GE Capital will need a $20 billion cash infusion to last the next 2 years alone). While their jet engines and power generation turbines are great, the company leadership ran it off the cliff with moronic forays into lending businesses. For example, instead of selling a jet engine, and perhaps lending the money to purchase most of that engine – GE would lend the money for the entire plane, many multiples of the value of their engine. So if there is an industry downturn, loan losses would subsume all profit and then some. GE also made mistakes in commercial real estate loans and even poor-credit consumer loans in Europe. The result of all these loans going bad during 2007-2009 is GE became a zombie company. In 2000, the stock price peaked at $60.50 in 2000 and as I write this the price is under $9, a capital loss of 85%. If GE survives enough decades to take profits from their manufacturing operations to shovel at their loan losses, perhaps it could survive without going through bankruptcy.

Deutsche Bank

Deutsche Bank (DB), is another company that is over 100 years old, a German bank that grew to become one of the top 20 banks in the world. Unfortunately, they made 2 critical errors. First, they loaded up on U.S. subprime mortgages before the U.S. real estate bust in 2008. Second, they went really big into all kinds of derivative contracts that created several financially unfeasible risks that it did not understand. These mistakes resulted in losses so large that the European Union had to bail them out, and their risk exposure is still many multiples larger than the entire European economy. The next recession may force Deutsche Bank into bankruptcy because it still fails “stress tests.” Deutsche Bank’s liabilities are so enormous (tens of trillions of dollars) that if it declares bankruptcy, the European Union itself may collapse just like the U.S.S.R. did in 1991.

Adding to these risks are fines and penalties. Like nearly every big bank, Deutsche Bank also periodically gets caught engaging in systemic fraud: rigging the gold market, rigging Libor interest rates, rigging foreign exchange rates, tax evasion, suspicious trading in Russia, violating UN economic sanctions to half a dozen countries, and money laundering for criminal cartels.

While Deutsche Bank’s stock price peaked in 2007 at $159.76, as I write this it is under $10 per share, a capital loss of 94%.

The Japanese Yen

If GE went through bankruptcy, the failure would be negligible to the world’s economy. DB’s failure would be a storm across all of Europe. But the big zombie nearing collapse is the Japanese Yen which would impact the whole world.

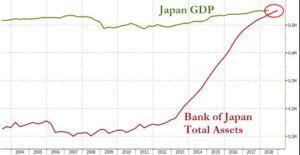

The Bank of Japan (their Central Bank) has been propping up the Japanese economy since the late 1990s. By suppressing the value of their currency for cheap exports, combined with propping up insolvent banks still wasn’t enough to help their economy. So the Bank of Japan continued printing more and more money to: pay unaffordable public pensions; prop up their bond market; and finally, propping up their stock market. The Bank of Japan just hit a new record on November 10th. The Bank of Japan has a balance sheet as large as the country’s annual GDP, 552.8 trillion yen. This means Japan’s central bank has printed so much extra money it has been able to purchase a year of the country’s output. The Japanese central bank’s debt to GDP ratio is an unheard of 253% (as a comparison, the U.S. is 20%). The central bank has been taking this extra money printing and not only buying bonds with it (to reduce interest rates), but buying Japanese Stocks (through exchange-traded funds). The Bank of Japan has bought so much stock that it now owns 55% of the outstanding shares of Japanese public companies!

Some call this a Ponzi scheme or counterfeiting money to confiscate assets. No matter, because the Japanese money-printing game will end once it hits some type of insolvency event. This event may be needing to borrow foreign money or the Japanese Yen falling in value so far that the Bank of Japan cannot provide it any support. Then Japanese inflation would explode, foreign debts could no longer be paid back, and the Central Banker’s money printing scheme will have run its course.