Wall Street is skilled at turning financial products (loans, leases, royalties, bonds) into securitized investment packages. Many of these turn out to be garbage which create huge losses for investors; such as: sub-prime auto loans, sub-prime home mortgages, trailer-park loans, credit card loans, and more. Some of these securities have collapsed on their own or are subsumed from an industry downturn. The most famous of which is the collateralized-debt obligations (mortgage CDOs) that were central to the 2008 financial crisis.

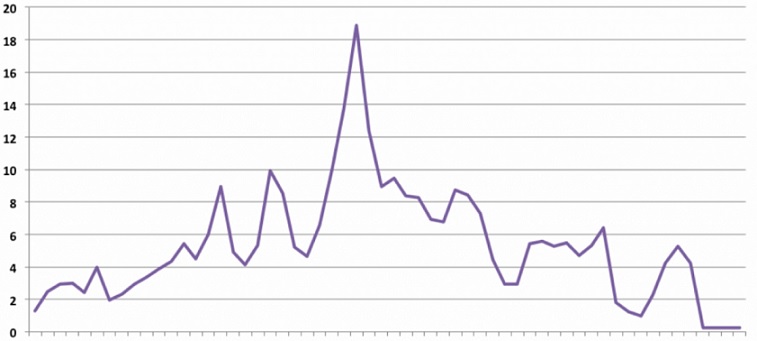

Since 2007, there has been an asset-backed security nicknamed SLABS (Student Loan Asset-Backed Securities). Public loans to college students are owned by the U.S. Treasury Department but private student loans are packaged and sold as SLABS. The student loans outstanding today is $1.5 trillion and growing; which some analysts are calling the next potential ‘debt bomb’ on the economy.

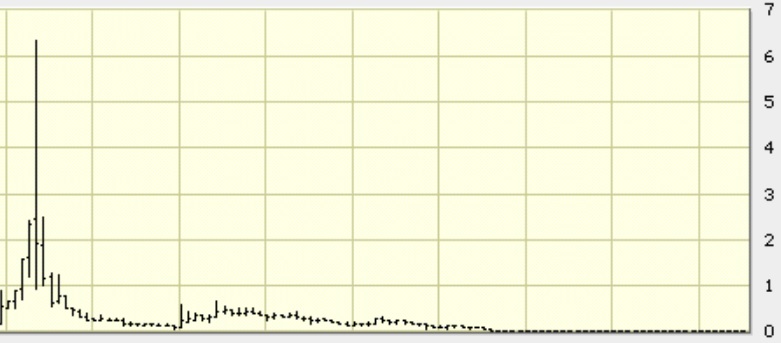

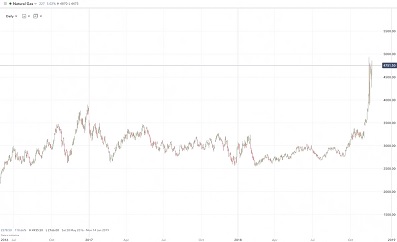

When interest rates are relatively low (as they have been since 2008), then some investors jump on any ridiculous and risky investment in order to gain a higher return. One of these was SLABS – they have been over-subscribed by a market that is starving for a reasonable yield. Investors that jumped in big overlooked two important factors: 33% of student loans are in deferral (not being paid currently) and 11% are in default. SLABS are a very poor risk pool with no collateral and, in my opinion, investors are not being nearly compensated enough for the risk that they are taking. Meaning that a portfolio of SLABS will most likely result in a net loss for investors no matter how well the future job market becomes. So, in 2016, it was not surprising when many tranches of SLABS were downgraded to junk credit. These ‘investments’ were issued with a high credit rating and just a few years later, their credit rating has fallen below investment grade to a junk rating.

SLABS are an investment that you do NOT want in your portfolio. Well, how about buying the U.S. public entity servicing these student loans? Navient (that trades like a stock with ticker symbol NAVI) is a candidate which is currently yielding 4.9%. Is this something to buy? Just the opposite: there are more investors talking about shorting this than buying it. This is partly because investors want to profit like the movie The Big Short when a few smart people made a fortune from the real estate downturn in 2008. Similarly, these investors are looking at NAVI as a short candidate to profit from the student loan defaults, and then, capture profit when the economy softens and the student loan default rate will soar.