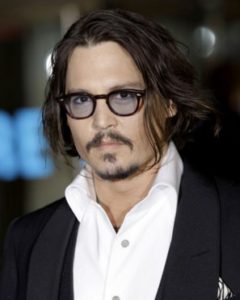

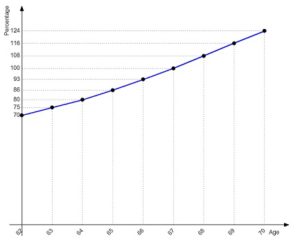

In Depp’s career, he has earned an unbelievable $650 million from his movies (plus more from endorsements). Sadly, Rolling Stone reported in a June 21st interview where he admits that he is broke. So Depp is another one of this year’s celebrity financial implosions. Naturally, there are some allegations of financial mismanagement by his advisors that will play out in court (but he’s only suing for $25 million). Nevertheless, it is a spectacular example to prove the timeless rule: there is no amount of income that can’t be outspent.

So where did his money go? A few expenditures include:

- $150 million payment to long-term ex-girlfriend Vanessa Paradis in 2012

- $75 million for 14 residences

- $7 million payment to ex-wife Amber Heard in 2016

- $5 million lost on his own record label company

- $3 million to shoot his deceased friend’s ashes from a cannon (Hunter S. Thompson)

- Plus hundreds of notable artwork and 45 luxury vehicles

Some of Depp’s annual expenses:

- $2.4 million on private travel

- $1.8 million for security

- $1.2 million for on-call doctor

- $400,000 on wine

While a fall from great heights is a titillating story, the lessons it provides are important to those on any level of income. Lessons such as spending less than you earn, saving money, financial stability, managing your money or managing your money managers. (Although, this is more difficult if the rumors are true from Depp’s former staff that his life is a storm of illegal drugs, alcohol, and chaos).

Thankfully, Depp has been doing something about his financial predicament with touring income with his band (Hollywood Vampires), attempting to continue his Pirates of the Caribbean movie franchise, and getting some better financial advisers.