One government retirement plan was just closed out as a colossal failure last year, and the statists are pressing for yet another government-run savings account. At a Detroit Economic Club speech last month, the billionaire Executive Vice Chairman of Blackstone, Tony James, wants a national savings account that is mandatory for all employees. James and a labor economist, Dr. Teresa Ghilarducci, co-authored a new book to promote this retirement account along with corresponding tax credits.

Let’s review a few off-hand problems with their plan:

- Social Security is already a mandatory government retirement account that has become mis-managed. The moment budgets got tight, politicians effectively replaced the cash with some “custom” U.S. Treasury debt instead. If social security were viewed as an investment, for many groups of people the return is negative (depending on your marital status and how long you live). Social Security is scheduled to be broke in 16 years and Medicare is scheduled to be broke in 8 years. This account will be no different.

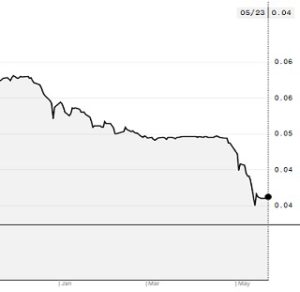

- The last national retirement account, Obama’s MyRA, was launched by the federal government in 2014 and cost $70 million to start-up. This horrible account was shut down in under 3 years for lack of participation. When people reject bad statist ideas, the statists respond by trying to make them mandatory.

- As history has proven, all of the state-run college funds underperform and over-charge.

- For the last 16 years, James has worked for Blackstone, the giant money management company. What better way for James to make more money than mandate another big pot of money to manage and siphon fees. Mr. James hasn’t been so forthcoming with this conflict of interest. Meanwhile, Dr. Ghilarducci, a labor economist and Hillary Clinton adviser, and wants ALL current retirement accounts to be controlled and managed by (wait for it) the U.S. Department of Labor. Where presumably, Ghilarducci would have had a job if Hillary Clinton had won the 2016 presidential election.

- The 3% savings rate that James advocates cannot mathematically add up to any kind of notable amount of money. It certainly cannot become a major part of someone’s retirement income, although their book argues that it will. Particularly if the money is placed into his recommended annuity; the highest fee-laden insurance/investment product that exists.

- Every few years, U.S. Congress tries to raid retirement accounts because they are easy targets: IRAs, Roth IRAs, 401(k)s, etc. and this new account will be no different. Once the account is started, there will soon be members of congress clamoring for “means testing” to get your money back. Meaning, if you earn over a certain threshold amount, then you are disqualified from receiving your fair-share of your money back. Then that threshold will be ratcheted down.

If the last +2,000 years of government handouts are any guide, then Washington politicians and Wall Street will be the only ones who benefit from this government savings account. Maybe a few crumbs might make it to retirees. A mandatory saving account is still stolen money. Your hard earned-money is taken from you, placed into a prison of high-fee, low-return investments, and maybe you’ll get a little back after you retire. That is the optimistic scenario – it is more likely that the government will change the rules so you effectively get very little back.

So what should be done about a low national savings rate?

I have observed only three inciting forces that raise personal savings rates:

- Ongoing financial education and exposure to personal financial concepts.

- Experiencing financial struggle from a lack of savings, either you or someone close to you.

- A broad economic calamity: economy collapse, currency collapse, hyper-inflation, etc. lasting enough years so that a high savings rate becomes ingrained in the culture.

The government could help more people, at a speck of the cost, by providing early financial education instead of another doomed socialist program.