Politicians seeking to achieve a social goal frequently use taxes as one of their tools. This tool is always a double-edged sword causing predictable side-effects that politicians routinely ignore. It is a lesson as old as civilization and quickly forgotten in spite of numerous examples.

My favorite two examples highlight an immediate and sharp behavioral response:

- U.S. Congress passed a 10% luxury tax on yacht sales in 1991, intending to grab easy money from the very rich. What actually happened? The rich bought their yachts from overseas instead so U.S. yacht sales fell by 56%. This eliminated 125,000 American jobs in the marine industry as yacht manufacturers went bankrupt or shrank. The policy was so disastrous that the luxury tax was repealed only 2.5 years after it was implemented; but it took decades for the industry to rebound.

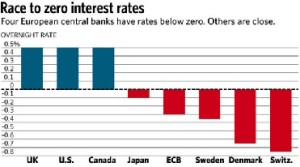

- Sweden passed a 0.50% financial transaction tax in 1984 on stocks and bond trades to raise easy money from the wealthy. Trading dropped so quickly that the tax it raised wasn’t enough to fund the government department in charge of tracking the tax. So the government doubled the tax and expanded it to other kinds of trading. What actually happened? Stock and bond trading dropped by 85%, futures trading dropped by 98%, and options trading went to zero. Within a few years the majority of Swedish securities trading had all moved to London. Since trading plummeted, capital gains tax revenue disappeared and brokerage jobs disappeared. But these weren’t sufficient reasons to repeal the tax to the true believers of tax-the-rich. It wasn’t until the market illiquidity forced the government to pay a higher interest rate to sell their bonds that the tax was finally repealed in 1991. But it took nearly two decades for the industry to return from overseas.

So those tax examples were from long ago, what about right now?

- Last year, the City of Philadelphia passed a 1.5 cents/ounce tax on sugary drinks like Coca-Cola, iced tea, Gatorade, fruit punch, energy drinks and some coffee drinks. The city council claimed this would reduce obesity and the $91 million in new tax revenue would be spent on pre-kindergarten programs in poor areas and shore up the city’s budget. What actually happened? Since the tax raised the price of these sugar products by 30-50%, sales have dropped by 32% so far within in the city and skyrocketed outside of the city limits.

- The Los Angeles Chinatown area pleaded with Wal-mart for years to open a store near them. Wal-mart finally opened that store in 2013 where customers could access much cheaper food, prescriptions, and other items to reduce their cost of living. But, Los Angeles passed a new minimum wage starting at $15/hour in 2017 and going higher in 2018. Wal-mart operates on tiny profit margins, so rather than lose money they closed the store the first month the tax went into effect. Not only has the area lost a large employer, but their cost-of-living just went up without a discount merchandiser – leaving Chinatown economically worse off than before the wage hike.

- San Francisco raised their minimum wage 86% above the federal minimum wage, with additional hikes scheduled up to $15/hour by 2018. The actual result? Unlike the rest of the country, San Francisco has seen prices rise by 10% or more on of all kinds of commodities. What about businesses that rely the most on minimum wage employees? A recent Harvard study concluded that while high-end restaurants are unaffected by a small minimum wage hike, average restaurants are 14% more likely to close for every 10% increase in the minimum wage above the federal level.

There is no magic wand that allows a tax increase to have no impact on behavior. Any price increase is met with a reduction in demand and people will begin searching for alternatives or creating substitutes. Many people still believe there is an immunity bubble around wages and jobs, but +100 years of minimum wage experiments around the world has proven that labor is simply another commodity subject to the rules of basic economics as well. So the next time you hear about a politician’s new tax hike, prepare for the predictable consequences that will blind-side some class of unintentional victims.