Creating a ratio by dividing the price of one asset by another is one way to determine if something is relatively cheap or expensive. For example, comparing gold/silver, stock market/oil, real estate/stock market, and numerous other ratios. In general, you are seeking an extreme low ratio to buy one and sell the other (as a pair trade) and when the ratio is extremely high, do the opposite trade. This is called relative value trading, trading one product (a long position) against another product (with a short position).

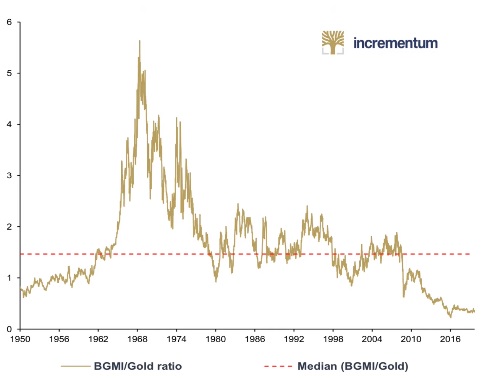

There is a ratio extreme right now between gold mining companies and gold; which has an average of 1.5 Gold Miners/Gold over the last 70 years. As you can view in the chart, gold miners have not been this cheap compared to the price of gold since the 1950s. Could the ratio go lower? Absolutely, much lower. However, the ratio has been moving sideways since 2016.

This could be a great trade as gold mining stocks usually move up 2-6 times over the price of gold, when there is a big run up in gold price. Be aware that junior gold mining stocks (ticker GDXJ) are more volatile and riskier than larger gold mining stocks (ticker GDX). One gold analyst said that, “If the price of gold make a new all-time high, then I’m going to buy gold mining stocks to get an added boost in return.”